OPEC promised to stabilize supply during the second half of 2015 and blame the sharp decline to increased production from non-OPEC members. OPEC has been producing around 30 million barrel per day for almost a decade.

Lately USA is producing shale oil and non open members are competing for a 20% share of the global market. Many European countries are consuming less and less oil because of natural gas consumption or because of more efficient combustible engines.

financial stability risks are evolving as expected in January!!!!

What is a reasonable oil barrel price?

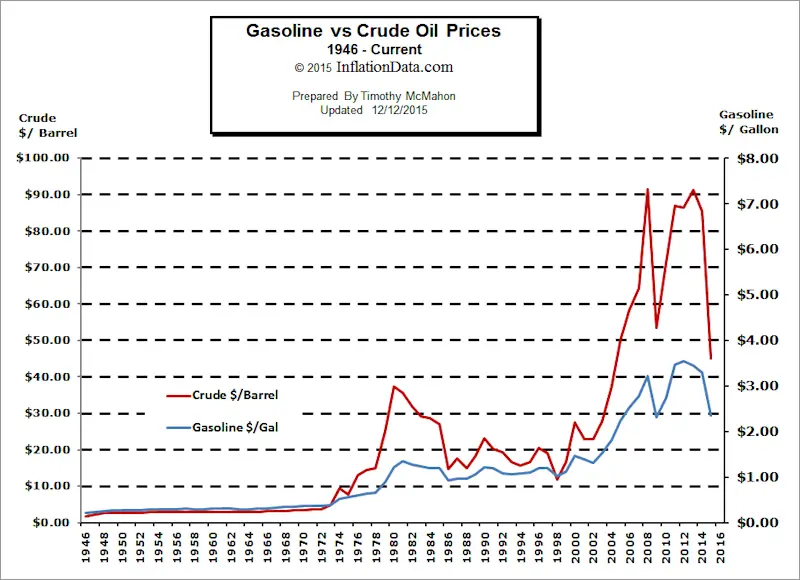

This is the break down of an crude barrel. The majority of the output is in jet fuel and gasoline for our cars. An easier comparison is to link the crude price to the gas prices in the market because everybody can see those numbers every day.One can look at the following chart and implies a reasonable factor between crude price and gas prices.

A quick ratio can be around 25. Every barrel of oil was costing around 20-25 gallons of gas in US gas stations. The gas prices are much more stable than oil prices and hence when the barrel price is way above 25 times the gallon of gas, it should ring some bells. When it falls way below the price of 20 gallons of gas, it means the market is not left to its equilibrium. There are many causes for this concern:

- Higher demand for gas (summer months)

- Higher supply for oil (Saudi is not happy with Iran)

- Higher pressure from USA or China for cheaper oil during crisis times

- Unexpected market adjustments (short terms only).

No comments:

Post a Comment